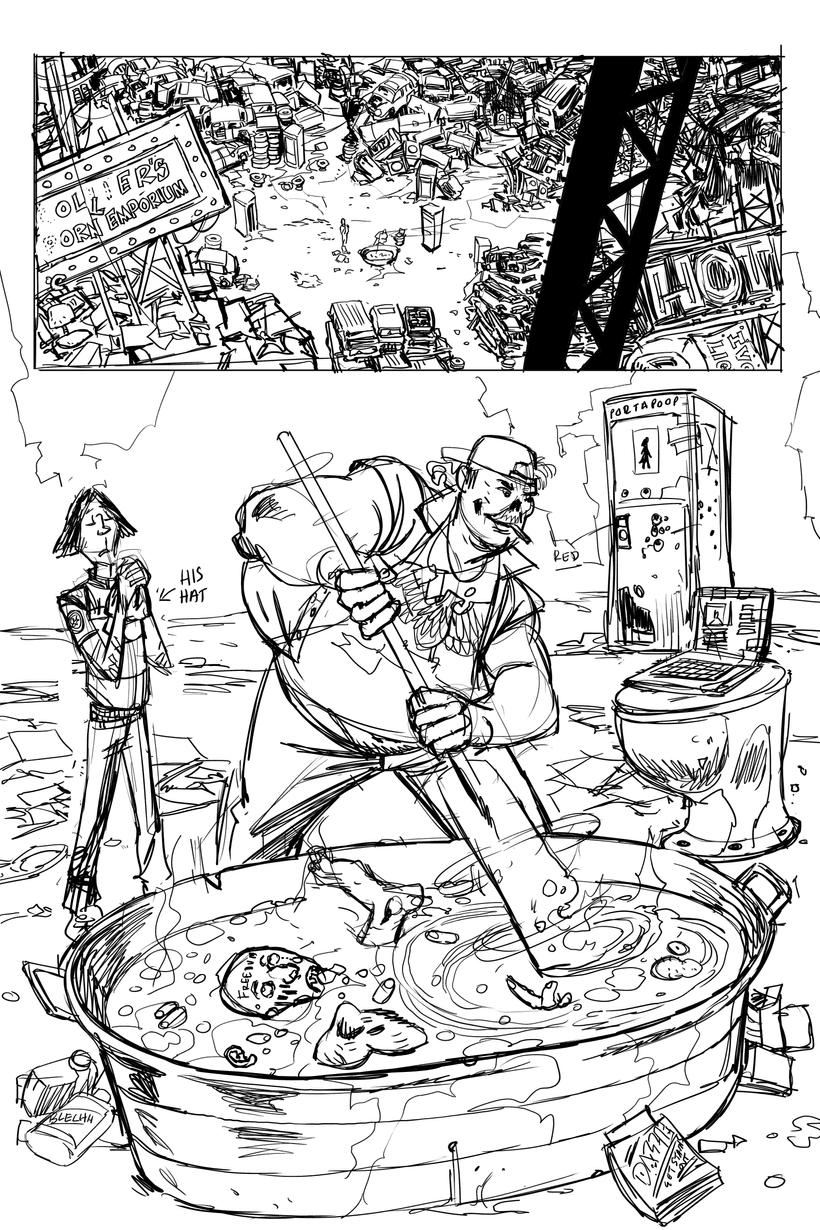

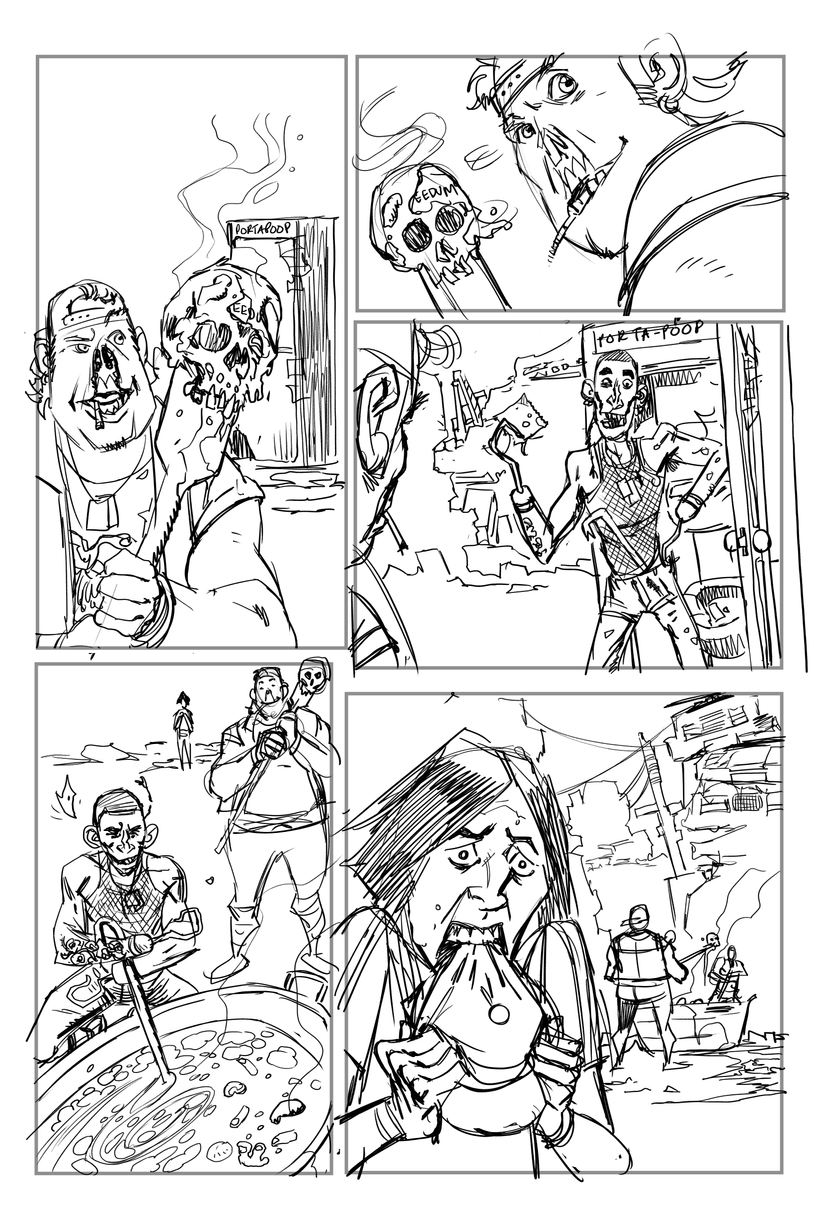

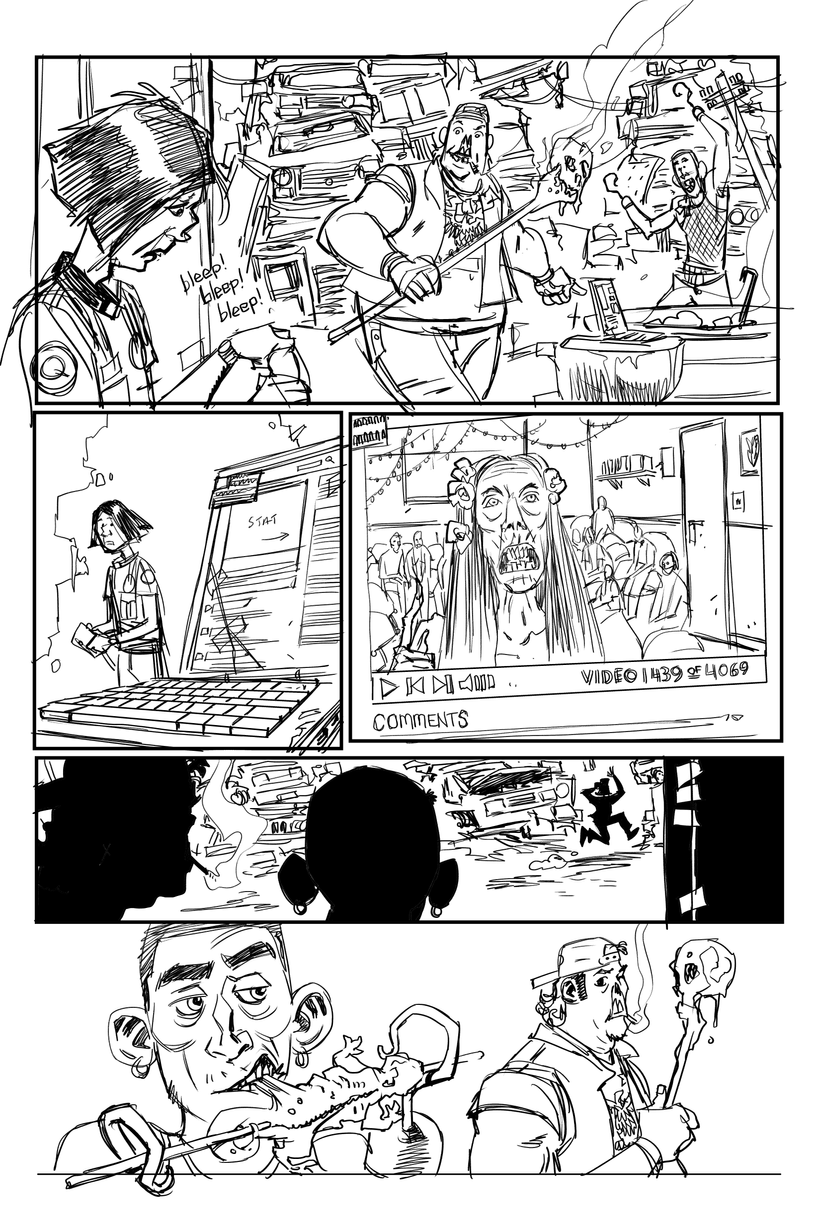

Look, I hsouldn’t do this. This is script that hasn’t been edited (and the last script I did write it was so heavily redrafted there was barely anything left from first to last draft) on the other hand I’m at my brother’s house and I can’t do any inking up here and I fancied pencilling the first page, so here it is.

My plan, on Monday is to see if I can get some notes, do another draft (largely around dialogue though unless someone suggests an idea so brilliant that I’d be an idiot not to include it) and then maybe pitch it to some anthology title somewhere – if not 2000ad. I can’t really submit it to 2000ad until I’ve finished the work I’m currently doing for them. Though maybe a second draft will convince me otherwise. If it doesn’t go to 2000ad I‘ll look around for an anthology, I think my preferences are, in no particular order (though I’d have to submit it one at a time, so I’d probably look for who’s paying/whether it’ll see print/what can it do for my career):

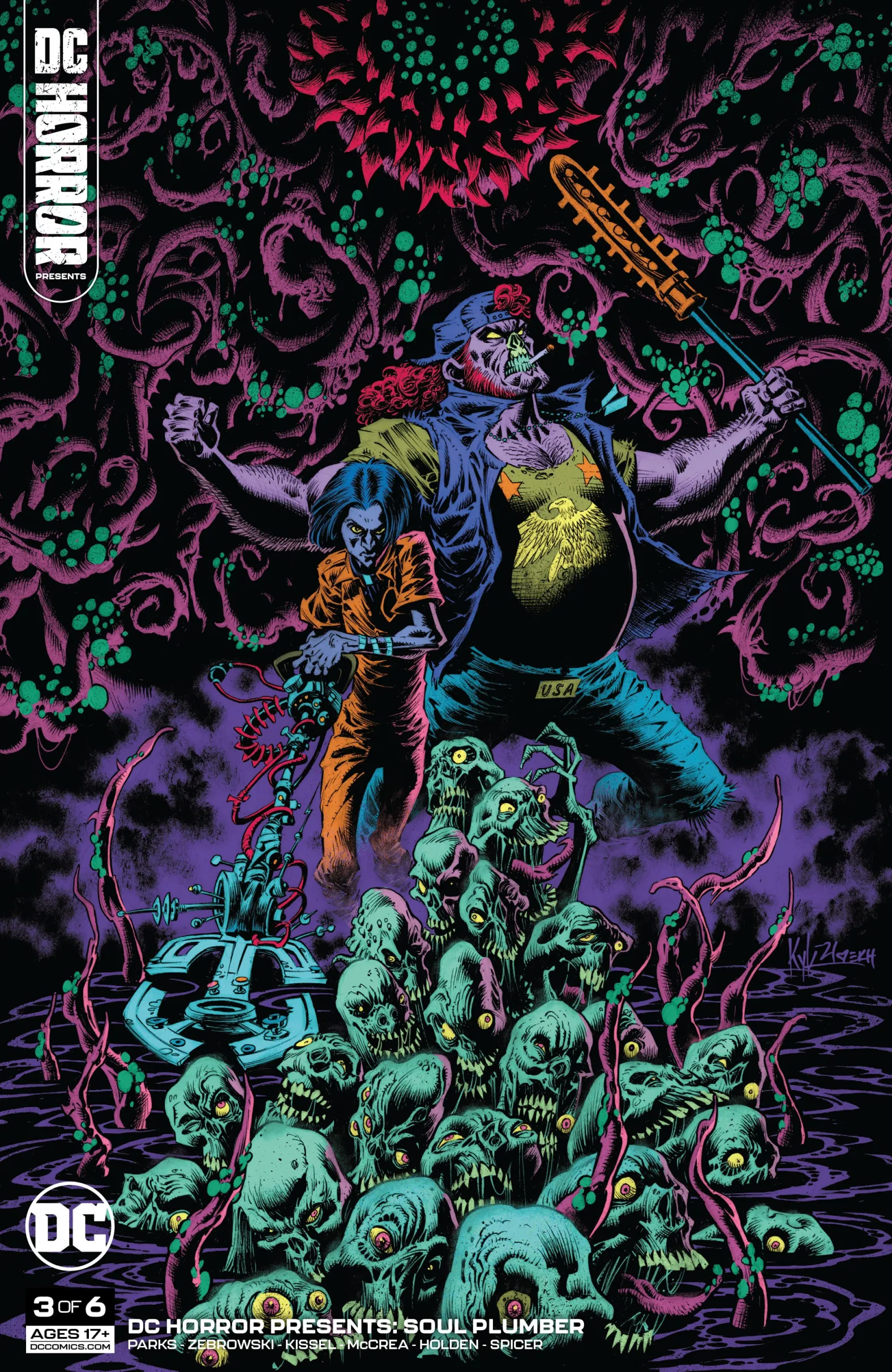

Heavy Metal (though I’m not mad keen on their NFT stuff) but I think they’d run the art and let me colour it and I’d probably try and push the art a bit more, more ornate, more HM.

RazorBlades – James Tynion‘s horror anthology – though it’s not quite horrific enough for that (I’d probably have to push the body horror more?)

Ahoy Comics (their “Snifter of Terror” would be a good fit…)

Shift Comics – a new UK anthology? cool.

The 77 – a pretty successful kickstarter backed UK comic, also cool.

There’s lots of factors when you’re thinking about submitting work; I like shift and the 77 and I’ve done something for the 77 in the past, but I’m not really expanding who sees my work in these anthologies – they are primarily UK anthologies and it’s likely they’re 2000ad crossover audience is pretty big. Plus the page rate would be pretty low (at a guess – not nothing, and creator owned, and it’s only four pages so it’s not like I’ll get rich doing it) so I think this will be my fallback option (unless I don’t just hoik it up online, but I find stuff sort of disappears when you do that)

AhoyComics would be fun, I like the books they do, it feels in my wheelhouse, though a four pager isn’t going to have much impact, it expands the publishers I’ve worked for and they can probably pay US my page rates. Not sure about ownership.

Razorblades would be great, as far as I know it’s creator owned work, so I get to keep the copyright (a thing not true of 2000ad) and it would be good to get in the orbit of Tynion who seems to be going places. Page rate I’m not sure about, but it’s the sort of venue I’d consider not worrying about it for four pages.

And finally Heavy Metal, sort of vague ambition to be published in Heavy Metal, certainly would’ve been a brilliant thing to say in my 20s/30s, now, in my 50s, it’s a little nostaligic notion even as I realise it’s not the magazine of my youth (and nfts? eyeuch)

Anyway, this is the sort of shit that goes through my head. Hope you like this page 1, it may end up looking nothing this by the time I find a publisher / home for it and it gets an editor inspired rewrite…